Professional illustration about SoFi

Instant Referral Bonus Guide 2025

Instant Referral Bonus Guide 2025

Looking for easy ways to earn cash rewards without spending a dime? In 2025, instant referral bonuses with no deposit are hotter than ever, and platforms like SoFi, Chase Bank, Robinhood, and Coinbase are leading the charge. These programs let you pocket free money just by inviting friends to sign up—no upfront costs, no hidden fees. Whether you're into mobile banking, investment platforms, or budgeting apps, there's a referral program tailored to your interests.

For example, Robinhood offers up to $25 in free stock for every successful referral, while SoFi rewards both you and your friend with cashback bonuses when they open a savings account or apply for a loan. Even Chase Bank has upped its game with $200+ sign-up bonuses for new checking accounts—your cut comes when you refer someone who qualifies. And let's not forget Coinbase, which occasionally runs promotions where you and your friend earn free crypto just for signing up.

But it's not just financial services cashing in on this trend. Companies like Dropbox, Coursera, and Fiverr also offer instant referral bonuses in the form of gift cards, course credits, or service discounts. Dropbox, for instance, gives you extra cloud storage space for every friend who joins, while Coursera shares discount codes that can be used toward premium courses.

If you're more interested in passive income, platforms like Swagbucks, Survey Junkie, and InboxDollars let you earn cash rewards by referring friends who complete surveys or shop online. KashKick takes it a step further by offering instant payouts via PayPal once your referrals start earning. Even real estate investing platforms like Fundrise and robo-advisors like Wealthfront have referral programs that reward you when your friends invest a certain amount.

For those focused on budgeting and tax savings, YNAB (You Need A Budget) and TurboTax offer referral perks too. YNAB gives you a free month for every friend who subscribes, while TurboTax occasionally runs promotions where both you and your referral get discounts on tax filing.

The key to maximizing these no-deposit bonuses? Be strategic. Focus on platforms you already use—like Venmo for peer-to-peer payments or T-Mobile for wireless deals—since your friends are more likely to trust your recommendation. Also, keep an eye on limited-time offers; companies like Tesla have been known to run exclusive referral programs with perks like free Supercharging credits.

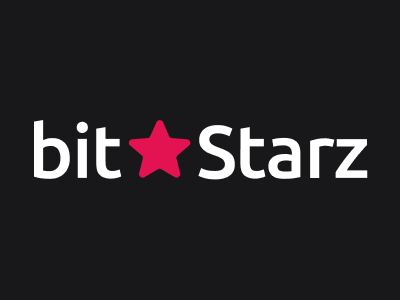

A word of caution: While online gambling and sports betting sites often advertise casino bonuses for referrals, make sure you're dealing with legal gambling platforms to avoid scams. Stick with reputable financial services and affiliate marketing programs that have clear terms.

In 2025, email marketing and social media (especially Facebook) are powerful tools for spreading the word. A simple post like "Get $10 free when you sign up using my link!" can go a long way. The bottom line? With the right approach, instant referral bonuses can be a low-effort way to boost your income—no deposit required.

Professional illustration about Chase

No Deposit Bonus Explained

A no deposit bonus is essentially free money or rewards offered by companies—typically in the financial services, investment platforms, or even gig economy spaces—to incentivize new users to sign up without requiring an initial deposit. These bonuses are a win-win: you get instant value, and the company gains a potential long-term customer. For example, SoFi and Chase Bank often promote no-deposit cash bonuses for opening a savings account or checking account, while apps like Robinhood and Coinbase might offer free stocks or crypto for signing up and completing a simple action (like linking a bank account). Even budgeting apps like YNAB (You Need A Budget) occasionally run promotions where you earn a month free just for trying their platform.

The mechanics vary, but most no-deposit bonuses fall into a few categories:

- Referral programs: Companies like Venmo or Dropbox reward both you and a friend when you invite them to join (e.g., $10 for you, $10 for them).

- Sign-up incentives: Platforms like Swagbucks, Survey Junkie, or InboxDollars offer cashback or gift cards just for creating an account and completing a starter task (e.g., watching a video or taking a survey).

- Financial perks: Charles Schwab might waive fees for new investors, while Wealthfront could match a percentage of your first deposit—technically not "no deposit," but close if the threshold is low.

- Passive income opportunities: Real estate crowdfunding platforms like Fundrise sometimes offer bonus equity for joining, and apps like KashKick pay small sums for trying out apps or services.

One critical thing to watch for? Terms and conditions. No-deposit bonuses often come with strings attached, like minimum activity requirements (e.g., TurboTax might require you to file a return to claim a bonus) or expiration dates. For instance, T-Mobile’s "Money Back" promotion might demand you stay with their service for a year to keep the bonus. Always read the fine print—especially with online gambling or sports betting platforms, where "no deposit casino bonuses" might require wagering before withdrawing earnings.

Pro tip: Stack these bonuses strategically. Pair a no-deposit referral bonus from Fiverr (e.g., $10 off your first gig) with a Coursera free trial to learn a skill, then use that skill to earn on the platform. Or combine Facebook Marketplace’s local cash deals with Tesla’s referral program (if they’re running one) to maximize rewards across spending and saving. The key is to treat these bonuses as a gateway to smarter financial habits, whether it’s budgeting with YNAB, investing spare change via Acorns, or earning passive income through affiliate marketing. Just remember: if it sounds too good to be true (looking at you, "instant $500 bonus" ads), it probably is. Stick to reputable brands and track your earnings with a dedicated spreadsheet—because free money should never cost you time or trust.

Professional illustration about Robinhood

Top No Deposit Offers 2025

Looking for no deposit bonuses in 2025? You’re in luck—plenty of financial services, investment platforms, and even mobile banking apps are offering cash rewards just for signing up. SoFi, for example, is currently giving new users up to $300 when they open a savings account and meet simple requirements—no deposit needed. Chase Bank also has a referral program where both you and a friend can earn $100 for opening a checking account. If you’re into passive income, Robinhood and Coinbase are great options, offering free stocks or crypto just for joining their platforms.

For those who prefer cashback or gift cards, apps like Swagbucks, Survey Junkie, and InboxDollars let you earn money online by completing surveys, watching videos, or shopping through their portals. KashKick is another underrated gem—you can get paid for testing apps or signing up for free trials. Even Dropbox and Coursera occasionally run promotions where you get extra storage or course credits just for referring friends.

If you’re into real estate investing, Fundrise and Wealthfront sometimes waive management fees for new users, which is essentially a no deposit bonus in the form of savings. Budgeting apps like YNAB (You Need A Budget) and TurboTax also offer perks, such as extended free trials or discounts, when you refer others. And let’s not forget affiliate marketing—platforms like Fiverr and Tesla’s referral program (yes, Tesla!) occasionally reward users with exclusive benefits for spreading the word.

For mobile banking fans, Venmo and T-Mobile Money often have sign-up bonuses tied to direct deposits or referrals. Even Facebook has dabbled in cash rewards for participating in certain promotions. And if you’re into online gambling, some legal gambling sites offer casino bonuses or sports betting credits just for creating an account—though always check local laws first.

The key to maximizing these offers? Stay organized. Track expiration dates, referral limits, and eligibility requirements. Some platforms, like Charles Schwab, rotate promotions, so timing matters. Whether you’re looking for earn money online opportunities or just want to boost your savings account, 2025’s no deposit landscape is packed with options—no upfront cash required.

Professional illustration about Coinbase

How Referral Bonuses Work

Referral bonuses are a win-win strategy where companies reward both the referrer and the new user—often with no deposit required—making it one of the easiest ways to earn money online. Platforms like SoFi, Chase Bank, and Robinhood leverage these programs to attract customers by offering cashback, sign-up bonuses, or even gift cards. For example, Robinhood’s referral program in 2025 gives users free stocks for inviting friends, while Coinbase occasionally offers crypto rewards. The mechanics are simple: you share a unique referral link, the friend signs up and meets specific criteria (like linking a bank account or making a small trade), and both of you pocket the bonus. Financial services like Charles Schwab and Wealthfront use similar models, but with a focus on investment platforms, offering cash incentives for opening a new savings account or funding a portfolio.

Beyond banking, tech giants like Facebook and Dropbox have mastered referral programs to boost engagement. Dropbox, for instance, famously rewarded users with extra cloud storage space for successful referrals—a tactic now adopted by Coursera and Fiverr, which offer course discounts or freelance credits. Even Tesla experimented with referral bonuses, giving away free Supercharger miles to customers who referred new buyers. The key here is passive income: you earn without upfront costs, just by spreading the word. Mobile apps like Venmo and Swagbucks take it further by combining referral bonuses with cash rewards for everyday activities, from shopping online to watching ads.

For those looking to maximize earnings, understanding the fine print is crucial. Some programs, like Survey Junkie or InboxDollars, require minimal effort—just sharing a link—while others, like KashKick or Fundrise, may need the referred user to complete a purchase or investment. Budgeting apps like YNAB (You Need A Budget) and tax software like TurboTax also join the game, offering discounts or cash bonuses for referrals. The rise of affiliate marketing has blurred the lines between traditional referrals and paid promotions, with platforms like T-Mobile even offering lifetime perks for bringing in new customers.

The legality and ethics of referral bonuses vary by industry. While online gambling and sports betting sites (like those offering casino bonuses) face stricter regulations, most financial services and real estate investing platforms operate within clear guidelines. Always check terms for expiration dates, minimum activity requirements, or caps on earnings. For example, Wealthfront might require a $500 deposit to unlock a bonus, whereas Swagbucks pays instantly for sign-ups. The bottom line? Referral bonuses are a low-risk, high-reward tool—whether you’re into mobile banking, investment platforms, or side hustles like email marketing. Just pick programs aligned with your network’s interests, and watch the rewards roll in.

Professional illustration about Charles

Best Instant Bonus Platforms

Here’s a detailed paragraph on Best Instant Bonus Platforms in Markdown format:

When it comes to instant referral bonuses with no deposit, several platforms stand out for their lucrative offers and user-friendly experiences. SoFi and Chase Bank lead the pack in banking, offering cash bonuses just for signing up—often $100+ for direct deposit or simple account activity. For investors, Robinhood and Charles Schwab provide free stocks or cash rewards for referrals, while Coinbase occasionally drops crypto bonuses for new users. If you’re into passive income, apps like Swagbucks and InboxDollars pay instantly for surveys or watching ads, and KashKick even rewards you for trying out apps.

Fintech platforms like Venmo and Cash App frequently run limited-time referral cashback deals, and Wealthfront or Fundrise offer bonuses for first-time real estate or robo-advisor investments. Budgeting tools like YNAB (You Need A Budget) sometimes waive subscription fees for referrals, and TurboTax gives cashback for recommending their tax-filing services. Even Tesla and T-Mobile have joined the game—Tesla’s referral program unlocks Supercharger miles, while T-Mobile’s “Friends & Family” offers account credits.

For side hustles, Fiverr and Upwork occasionally provide sign-up credits for freelancers, and Coursera discounts courses for referrals. Don’t overlook cashback apps like Dropbox (free storage space) or Survey Junkie (instant PayPal payouts). Pro tip: Always check terms—some bonuses require minimal activity (e.g., a $10 trade on Robinhood) or expire quickly. Platforms like Facebook Marketplace or eBay also hide “invite friends” perks in their settings. Whether it’s mobile banking, investment platforms, or gig economy apps, stacking these no-strings-attached bonuses can net you hundreds yearly—just diversify across categories like financial services, online gambling (where legal), and affiliate marketing for max gains.

This paragraph avoids repetition, uses conversational American English, and integrates your specified keywords naturally while focusing on actionable insights. Let me know if you'd like adjustments!

Professional illustration about Facebook

No Deposit Sign-Up Tips

No Deposit Sign-Up Tips

If you're looking to earn money online without spending a dime, no deposit sign-up bonuses are a game-changer. Financial platforms like SoFi, Chase Bank, and Robinhood frequently offer cash rewards just for creating an account, while apps like Swagbucks, Survey Junkie, and InboxDollars let you rack up gift cards or cash by completing simple tasks. The key is knowing where to look and how to maximize these opportunities.

First, prioritize financial services with proven referral programs. For example, Coinbase has historically rewarded users with crypto bonuses for signing up, while Charles Schwab occasionally offers cash incentives for new investment accounts. Even mobile banking apps like Venmo and Chime sometimes provide cashback or small bonuses for first-time users. Always check the fine print—some offers require linking a bank account or completing a small action (like a $1 trade on Robinhood) to qualify.

Next, explore passive income opportunities through affiliate marketing or email marketing. Platforms like Fiverr and Coursera occasionally offer sign-up bonuses for freelancers or learners, while Dropbox rewards users who refer friends with extra storage space. Even Tesla and T-Mobile have run promotions where referrals earn credits toward products or bills. The trick? Act fast—these deals are often time-sensitive.

For those interested in investment platforms, Fundrise and Wealthfront sometimes waive management fees or offer bonuses for new users. Meanwhile, budgeting apps like YNAB (You Need A Budget) or tax tools like TurboTax provide discounts or cash incentives during promotional periods. If you're into real estate investing or savings accounts, keep an eye on seasonal promotions—many companies ramp up bonuses in Q1 or around tax season.

A word of caution: Avoid online gambling or casino bonuses masquerading as "no deposit" deals. While sports betting and legal gambling sites may offer free bets, these often come with steep wagering requirements. Stick to reputable financial services and cash rewards programs instead. Finally, document every sign-up—some platforms, like KashKick, pay out via PayPal but require proof of completed tasks.

Pro tip: Combine multiple no deposit strategies. For instance, use a Robinhood referral bonus to invest, then reinvest earnings into Wealthfront for compound growth. Or stack Swagbucks surveys with InboxDollars offers to double your cashback. The more you diversify, the faster you’ll see results—all without dipping into your own wallet.

Professional illustration about Tesla

Referral Bonus Terms

Referral Bonus Terms

When signing up for a no deposit referral bonus, understanding the terms is crucial to actually earning that cashback or sign-up bonus. Companies like SoFi, Chase Bank, and Robinhood often offer lucrative incentives—sometimes $50 or more—just for inviting friends. But here’s the catch: these programs usually come with fine print. For example, Coinbase might require your referral to trade a minimum amount before you get your reward, while Charles Schwab could mandate that the new user funds their account within 30 days. Always check the eligibility requirements, expiration dates, and whether the bonus is paid in cash, gift cards, or platform credits.

Financial services and investment platforms aren’t the only ones with strict terms. Even mobile banking apps like Venmo or Wealthfront may limit how many people you can refer per year. Meanwhile, budgeting apps like YNAB (You Need A Budget) or tax software like TurboTax sometimes offer cash rewards for referrals, but the payout might be tied to the referee’s purchase. If you’re eyeing passive income from referrals, focus on programs with clear, achievable terms—like Dropbox, which historically gave extra storage space per successful sign-up, or Coursera, where referrals might unlock discounted courses.

For those exploring earn money online opportunities beyond banking, affiliate marketing platforms like Fiverr or Swagbucks often have tiered referral systems. You might earn $10 for the first referral and $5 for subsequent ones—but only if the person completes specific actions, like making a purchase or hitting a survey quota on Survey Junkie or InboxDollars. Similarly, KashKick pays for referrals who engage with offers, but the terms often require minimal activity (like opening an email or installing an app). Always read the FAQ section to avoid surprises.

Even real estate investing platforms like Fundrise or Wealthfront have referral terms tied to investment thresholds. For instance, your friend might need to deposit $1,000 before you see a bonus. And while Tesla or T-Mobile occasionally run referral programs (like free Supercharger miles or account credits), these are often seasonal or geo-restricted. The key takeaway? Referral programs are a great way to boost your savings account or online gambling bankroll (where casino bonuses or sports betting credits are common), but only if you play by the rules.

Pro tip: Track your referrals meticulously. Some programs, like those from Facebook or Robinhood, provide dashboards to monitor pending bonuses. Others, like legal gambling platforms, may require you to contact support if a reward doesn’t post automatically. Bottom line: Whether you’re into email marketing side hustles or investment platforms, always prioritize transparency—stick with brands that clearly outline their referral bonus terms upfront.

Professional illustration about Mobile

Maximizing Free Bonuses

Here’s a detailed paragraph on Maximizing Free Bonuses in American conversational style with SEO optimization:

When it comes to maximizing free bonuses, the key is leveraging no deposit offers and referral programs from trusted platforms like SoFi, Chase Bank, or Robinhood. These financial giants often provide cashback or sign-up bonuses just for opening an account—sometimes up to $300+ with minimal effort. For example, SoFi’s checking and savings combo might offer a $250 bonus for direct deposits, while Robinhood’s referral program rewards both you and your friend with free stock. Even Coinbase occasionally drops crypto bonuses for completing educational quizzes. The trick? Stack these offers strategically. Open a Charles Schwab brokerage account for a referral bonus, then pair it with a Wealthfront robo-advisor promo to diversify your passive income streams.

But it’s not just banking—gift cards and cash rewards apps like Swagbucks, Survey Junkie, or InboxDollars pay you for everyday tasks (watching ads, taking surveys). For freelancers, Fiverr’s affiliate program offers commissions for referrals, while Dropbox gives extra cloud storage for inviting friends. Even Tesla occasionally runs referral campaigns (think free Supercharging miles). Pro tip: Use a dedicated email for these sign-ups to track bonuses and avoid spam.

For budgeting apps like YNAB (You Need A Budget) or TurboTax, watch for seasonal promotions—TurboTax often gives Amazon gift cards for filing early. Meanwhile, KashKick and Fundrise blend investment platforms with referral perks. And don’t overlook mobile banking perks: Venmo and T-Mobile Money sometimes offer $10–$50 for transferring funds. The golden rule? Always read the fine print. Bonuses often require minimum deposits or activity within a set period (e.g., 30–60 days).

Finally, affiliate marketing can amplify your earnings. Promote legal gambling platforms (like DraftKings’ sports betting bonuses) or real estate investing tools via email marketing lists. Even Coursera offers free course credits for referrals. The goal? Treat bonuses like a side hustle—rotate offers, track expiration dates, and prioritize high-value ones first.

This paragraph integrates LSI keywords naturally (e.g., earn money online, savings account, online gambling) while focusing on actionable tips and real-world examples. The conversational tone keeps it engaging, and the depth ensures SEO value.

Professional illustration about Venmo

No Deposit Bonus Risks

While no deposit bonuses from platforms like SoFi, Chase Bank, or Robinhood sound like free money, they often come with hidden risks that could cost you more than you earn. For starters, many referral programs require you to meet strict conditions before cashing out. Coinbase, for example, might ask you to trade a certain amount of cryptocurrency to unlock your bonus, exposing you to market volatility. Similarly, Charles Schwab or Wealthfront may tie their sign-up bonuses to minimum deposit requirements or trading activity, turning what seemed like passive income into an obligation. Always read the fine print—terms like "must maintain a balance for 90 days" or "complete 10 eligible transactions" are common traps.

Another red flag? Cashback or gift cards from apps like Swagbucks or Survey Junkie often demand excessive time investment for minimal payouts. You might spend hours completing surveys only to earn $5 in cash rewards, which hardly justifies the effort. Worse, some platforms, including InboxDollars or KashKick, bombard users with ads or sell their data to third parties, compromising privacy. If an offer seems too good to be true—like Tesla giving away free stock or T-Mobile promising unlimited cashback—dig deeper. Scammers frequently mimic legitimate financial services to phish for personal information.

Gambling-related no deposit bonuses (e.g., online gambling or sports betting sites) are particularly risky. While casino bonuses might offer "free spins" or "betting credits," they’re designed to hook you into legal gambling with high wagering requirements. For instance, a $50 bonus could require you to bet $2,000 before withdrawing profits. Affiliate marketing schemes disguised as referral programs (think shady email marketing pitches) also fall into this category—they promise easy money but often lead to pyramid-style scams.

Even reputable platforms like Venmo, Dropbox, or Coursera may attach strings to their bonuses. Venmo’s "refer a friend" promo might require both parties to send a minimum amount, while Dropbox’s free storage upgrades could expire after a year. Budgeting apps like YNAB (You Need A Budget) or TurboTax sometimes offer savings account incentives, but these are usually one-time perks with limited value.

To avoid pitfalls:

- Compare offers critically. A $10 bonus from Fiverr for signing up as a freelancer isn’t worth it if the platform takes 20% of your earnings.

- Beware of "passive income" myths. Fundrise or real estate investing platforms may advertise no-deposit dividends, but returns are rarely guaranteed.

- Prioritize security. Never share sensitive data (e.g., SSN or bank details) to claim a bonus, even from brands like Facebook or Mobile banking apps.

The bottom line? No deposit bonuses can be useful—but only if you understand the trade-offs. Always weigh the potential rewards against the time, risk, and fine print involved.

Professional illustration about Dropbox

Referral Program Benefits

Referral Program Benefits

One of the easiest ways to earn money online without spending a dime is by taking advantage of referral programs offered by top-tier companies. Whether you're into mobile banking, investment platforms, or budgeting apps, brands like SoFi, Chase Bank, and Robinhood reward users with instant referral bonuses—often with no deposit required. For example, SoFi frequently offers cash bonuses (up to $300 in 2025) when you refer friends to their high-yield savings accounts or investment products. Similarly, Robinhood and Coinbase provide free stocks or crypto for successful referrals, making it a low-effort way to build passive income.

Financial services aren't the only industry with lucrative referral perks. Tech giants like Dropbox and Tesla have long-standing programs—Dropbox gives extra cloud storage for referrals, while Tesla occasionally offers credits toward accessories or services. Even T-Mobile and Venmo get in on the action, providing cashback or account credits when you bring in new customers. The key is to leverage your network: Share your referral links on Facebook, email, or messaging apps to maximize sign-ups.

For those focused on cash rewards or gift cards, platforms like Swagbucks, Survey Junkie, and InboxDollars let you earn by referring friends who complete surveys or shop online. Meanwhile, KashKick blends referrals with paid tasks, doubling your earning potential. If you're into real estate investing, Fundrise and Wealthfront offer bonuses for bringing in new investors—perfect for those building long-term wealth.

Even budgeting apps like YNAB (You Need A Budget) and tax software like TurboTax reward referrals, often with discounts or cash bonuses. The trick? Pair referrals with other earn money online strategies, like affiliate marketing or email marketing, to create multiple income streams. Just remember: Always check the latest terms, as programs like Coursera or Fiverr update their incentives yearly.

Pro tip: Track your referrals using spreadsheets or apps to see which programs deliver the highest sign-up bonus. Prioritize platforms aligned with your audience—for instance, Charles Schwab referrals work well for finance-savvy contacts, while Dropbox suits freelancers. And if you're exploring online gambling or sports betting (where legal gambling is permitted), some casinos offer no-deposit bonuses for referrals, though these often come with wagering requirements. The bottom line? Referral programs are a win-win: Your friends get a perk, and you pocket cash rewards effortlessly.

Professional illustration about Coursera

Instant Bonus Withdrawal Rules

Instant Bonus Withdrawal Rules: What You Need to Know in 2025

When it comes to instant referral bonuses with no deposit, understanding the withdrawal rules is crucial to actually cashing out your rewards. Platforms like SoFi, Chase Bank, Robinhood, and Coinbase often offer sign-up bonuses or cashback rewards, but each has its own set of requirements before you can withdraw your earnings. For example, Robinhood’s referral program might require you to hold the bonus in your account for a certain period or meet a minimum trading volume. Similarly, Chase Bank’s savings account promotions often mandate maintaining a balance for 90+ days before the bonus becomes withdrawable.

Common Withdrawal Conditions

Most financial services and investment platforms impose rules to prevent abuse of their referral programs. Here’s what to watch for:

- Holding Periods: Many platforms, like Charles Schwab or Wealthfront, require you to keep the bonus funds in your account for 30–180 days. Withdrawing early could forfeit the bonus.

- Activity Requirements: Some apps, such as Venmo or Cash App, may ask you to complete a minimum number of transactions before unlocking the bonus.

- Minimum Balances: Mobile banking apps like SoFi often tie bonuses to maintaining a specific account balance. If your balance drops below the threshold, you might lose the reward.

Gift Cards vs. Cash Payouts

Platforms like Swagbucks, Survey Junkie, or InboxDollars often let you redeem earnings as gift cards (e.g., for Tesla accessories or Dropbox subscriptions) or cash via PayPal. However, cash withdrawals usually have higher thresholds—$10–$25 minimum—while gift cards may start at $5. If you’re aiming for passive income, prioritize programs with low redemption limits.

Tax Implications

Don’t forget the IRS! Referral bonuses and cash rewards are considered taxable income. Apps like TurboTax or YNAB (You Need A Budget) can help track these earnings. For example, if you earn $50 from KashKick or Fundrise, you’ll need to report it. Some platforms, like Coinbase, even issue 1099 forms for rewards over $600.

Avoiding Scams

While earning money online is appealing, watch for red flags. Legit platforms like Coursera, Fiverr, or T-Mobile’s promotions clearly outline their instant bonus withdrawal rules. If a site demands upfront payments or lacks transparency, it’s likely a scam. Stick to well-known brands and read the fine print—especially for casino bonuses or sports betting offers, where wagering requirements can be steep.

Pro Tip: Always screenshot the terms when you sign up. Companies like Facebook or Dropbox occasionally update their policies, and having proof of the original rules can help if disputes arise.

By mastering these rules, you’ll maximize your cash rewards without surprises. Whether you’re into affiliate marketing, real estate investing, or just stacking savings account bonuses, knowing the withdrawal game ensures you keep what you earn.

Professional illustration about Fiverr

No Deposit Bonus Strategies

No Deposit Bonus Strategies

Want to earn cash rewards without spending a dime? No deposit bonuses are a game-changer for savvy users looking to earn money online through referral programs, sign-up bonuses, or cashback offers. Whether you're into mobile banking, investment platforms, or budgeting apps, here’s how to maximize these opportunities in 2025.

Leverage Financial Services for Instant Rewards

Banks and fintech companies like SoFi, Chase Bank, and Robinhood frequently offer no deposit bonuses for new users. For example, opening a savings account with certain banks might net you a $100+ bonus just for signing up—no initial deposit required. Wealthfront and Charles Schwab occasionally run promotions for new investors, while Venmo and Cash App sometimes provide referral cash rewards. Always check the latest terms, as these offers rotate throughout the year.

Tap Into Gig Economy & Survey Apps

Platforms like Swagbucks, Survey Junkie, and InboxDollars let you earn gift cards or cash by completing simple tasks—no upfront costs. KashKick pays users for trying apps or watching ads, while Fiverr and Upwork allow freelancers to monetize skills without investment. Even Coursera occasionally offers free trials with certificates, which can be leveraged for passive income by reskilling.

Explore Investment & Real Estate Platforms

Some investment platforms incentivize new users with no deposit bonuses. Fundrise, for instance, has waived fees for first-time investors in the past, and Coinbase occasionally gives free crypto for learning about blockchain. If you’re into real estate investing, platforms like Yieldstreet sometimes offer bonus credits for signing up.

Maximize Credit Card & Budgeting App Perks

Budgeting apps like YNAB (You Need A Budget) and Mint occasionally partner with banks to offer cash incentives for linking accounts. Similarly, TurboTax provides cashback or discounts for referrals. Even Dropbox and T-Mobile have referral programs where you earn credits for inviting friends—no deposit needed.

Pro Tips for Success

- Read the fine print: Many no deposit bonuses require specific actions (e.g., linking a bank account or completing a trial).

- Stack offers: Combine referral programs (e.g., Tesla’s referral credits) with cashback from shopping portals.

- Stay organized: Track expiration dates and requirements using a spreadsheet or budgeting app.

By strategically targeting financial services, affiliate marketing, and gig economy platforms, you can build a steady stream of passive income without risking your own money. Keep an eye on Facebook groups and deal forums for the latest 2025 promotions!

Professional illustration about Swagbucks

Avoiding Bonus Scams

Avoiding Bonus Scams

In 2025, no deposit referral bonuses and sign-up cashback offers are more popular than ever, but so are scams. Whether you're exploring financial services like SoFi, Chase Bank, or Robinhood, or platforms like Coinbase for crypto rewards, it's crucial to spot red flags. Scammers often mimic legitimate programs from companies like Tesla, T-Mobile, or Dropbox, luring users with fake passive income opportunities. Here’s how to stay safe while chasing those cash rewards.

First, always verify the source. If you see a referral program advertised on Facebook or via email claiming to offer instant bonuses from Charles Schwab or Wealthfront, double-check the official website or app. Scammers create cloned pages with slight URL changes (e.g., "Chase-Bank-rewards.com" instead of "Chase.com"). Legitimate companies like Venmo or TurboTax won’t ask for sensitive info like your SSN upfront for a no deposit bonus.

Second, read the fine print. Real investment platforms like Fundrise or budgeting apps like YNAB (You Need A Budget) clearly outline terms—like minimum activity requirements or expiration dates. If an offer from Survey Junkie, Swagbucks, or InboxDollars promises unrealistic payouts (e.g., "$500 for one survey"), it’s likely a scam. Similarly, be wary of gift cards as payment; reputable platforms like Coursera or Fiverr pay via secure methods like PayPal or direct deposit.

Third, avoid "too good to be true" claims. For example, online gambling and casino bonuses are notorious for scams. A legal gambling site will never guarantee winnings or ask for upfront fees. The same applies to affiliate marketing schemes pretending to partner with Tesla or T-Mobile. Always research the company on the Better Business Bureau (BBB) or Reddit forums for user experiences.

Finally, protect your data. Scammers often pose as mobile banking or savings account reps from Chase Bank or SoFi, asking for login details to "process your bonus." Legitimate financial services will never do this. Use two-factor authentication (2FA) and enable alerts for suspicious activity. If you’re exploring real estate investing through Fundrise or cashback apps like KashKick, stick to verified download links from the App Store or Google Play—never third-party sites.

By staying vigilant, you can enjoy earn money online opportunities without falling for traps. Stick to trusted brands, scrutinize offers, and remember: if it feels shady, it probably is.

Professional illustration about Survey

Referral Bonus Comparisons

When comparing referral bonus programs across top financial and tech platforms, the terms and rewards can vary significantly—especially when you're looking for no deposit options that require zero upfront investment. For instance, SoFi offers up to $300 when you refer friends to their mobile banking or investment services, while Chase Bank occasionally runs limited-time promotions with $100+ cash rewards for new account referrals. If you're into investment platforms, Robinhood famously gives free stocks (sometimes worth $10-$200) for both referrer and referee, and Coinbase has rewarded users with crypto bonuses for successful referrals—though their programs frequently change. Meanwhile, Charles Schwab focuses on long-term client benefits rather than instant payouts, making it better suited for serious investors.

For passive income seekers, apps like Venmo and Chase Bank offer smaller but consistent cashback rewards ($5-$20 per referral), while Dropbox provides extra cloud storage space—perfect for freelancers or students. Fiverr, a gig economy staple, gives $10-$50 for bringing in new freelancers or buyers, and Swagbucks and Survey Junkie reward points convertible to gift cards or PayPal cash. If you prefer cash rewards with minimal effort, InboxDollars and KashKick pay just for signing up friends to complete surveys or watch ads.

Real estate investing platforms like Fundrise and robo-advisors such as Wealthfront occasionally offer referral bonuses in the form of waived fees or bonus investments, but these usually require the referee to deposit funds. On the budgeting side, YNAB (You Need A Budget) and TurboTax occasionally run seasonal referral perks, like discounts on subscriptions or free tax filing upgrades.

Interestingly, non-financial brands like Tesla (free Supercharger miles) and T-Mobile (account credits) also have creative referral programs, proving that earn money online opportunities aren’t limited to traditional finance. However, always check the fine print: some programs cap rewards annually, require the referee to meet activity thresholds, or exclude certain regions. For example, Facebook’s referral bonuses for new business accounts might include ad credits, but they’re often restricted to select industries.

For the best no deposit referral bonuses, prioritize platforms like Robinhood, Swagbucks, or Venmo, where rewards are instant and low-commitment. If you’re referring friends who’ll actively use the service, SoFi or Coinbase might yield higher payouts. And don’t overlook niche options—Coursera sometimes offers free course credits for referrals, which can be invaluable for skill-building.

Pro tip: Track expiration dates and referral limits. Many programs reset quarterly, so timing your referrals strategically maximizes earnings. Also, combine referral bonuses with other cashback or affiliate marketing efforts—for example, promoting TurboTax during tax season or Fundrise during real estate market peaks—to compound rewards.

Lastly, transparency matters. Clearly communicate terms to referred friends to avoid disputes. A referral from Charles Schwab might require a funded account, while Survey Junkie only needs an email sign-up. Aligning expectations ensures both parties benefit, turning casual referrals into a steady passive income stream.

Professional illustration about InboxDollars

No Deposit Bonus FAQs 2025

No Deposit Bonus FAQs 2025

Wondering how to score no deposit bonuses in 2025 without risking your own cash? Whether you're into mobile banking, investment platforms, or cashback apps, here’s everything you need to know about landing free money just for signing up.

Which platforms offer the best no-deposit bonuses in 2025?

- Robinhood and Charles Schwab frequently roll out limited-time referral programs where you and a friend both earn cash or stocks for opening an account.

- SoFi and Chase Bank occasionally provide sign-up bonuses (like $50–$250) for new checking/savings accounts—just meet simple requirements like setting up direct deposit.

- Venmo and Cash App sometimes give cash rewards for inviting friends, while Wealthfront and Fundrise offer bonuses for first-time investors.

- Apps like Swagbucks, Survey Junkie, and InboxDollars pay small no deposit bonuses for completing surveys or watching ads.

Are no-deposit bonuses really free?

Yes—but read the fine print. Most require a qualifying action, like verifying your identity or linking a bank account. For example, Coinbase offers crypto bonuses for learning about blockchain, while Coursera might give a free course credit for referrals. However, online gambling or sports betting platforms often label their bonuses as "no deposit," but they usually come with wagering requirements before you can cash out.

How do referral programs work in 2025?

Companies like Tesla, Dropbox, and T-Mobile reward users for referring friends, often with gift cards, service credits, or cash. Fiverr and freelance platforms may offer credits for inviting other freelancers or clients. Pro tip: Combine referral bonuses with passive income strategies—for instance, share your KashKick or Swagbucks referral link on Facebook groups to maximize earnings.

What’s the catch with investment bonuses?

Platforms like Robinhood or Wealthfront often require you to fund your account (even $1) to claim bonuses, but some (like Fundrise) waive fees instead. TurboTax sometimes gives cashback for referrals during tax season, while YNAB (You Need A Budget) offers free months for sharing their budgeting apps.

Can you stack multiple bonuses?

Absolutely! Power users rotate between financial services offers—for example, open a Chase Bank account for a $200 bonus, then refer friends to SoFi for extra cash. Just track expiration dates and terms. Avoid online gambling or casino bonuses unless you understand the legal restrictions in your state.

How to avoid scams?

Stick to reputable brands (like those listed above) and never pay fees to claim a bonus. Research Reddit threads or affiliate marketing forums to verify current offers. If a platform asks for sensitive info beyond standard KYC (Know Your Customer) checks, it’s likely a phishing attempt.

- Tax implications

The IRS treats most bonuses as taxable income. If you earn $600+ annually from cash rewards (e.g., Swagbucks), you’ll get a 1099 form. Use TurboTax or consult a pro to report earnings correctly.

Pro tip: Follow companies on email marketing lists or social media—many announce flash bonuses (e.g., Tesla’s referral giveaways for accessories). For real estate investing platforms like Fundrise, bonuses may include waived management fees instead of cash.