Professional illustration about Company

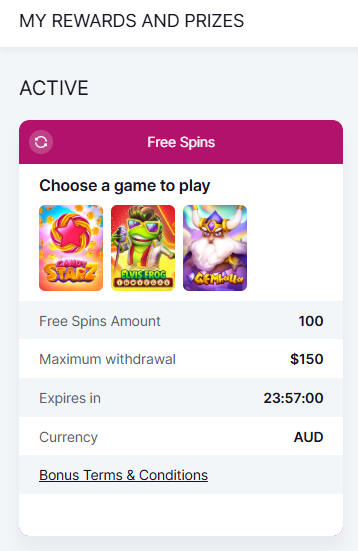

PayPal in 2025 Overview

PayPal in 2025 Overview

PayPal continues to dominate the digital payment landscape in 2025, offering a seamless blend of financial technology and user-friendly services. As one of the most trusted digital wallet platforms, PayPal integrates payment processing, online checkout, and buy now pay later options, making it a one-stop solution for consumers and businesses alike. The platform’s partnership with Mastercard and collaborations with institutions like Synchrony Bank and The Bancorp Bank ensure secure transactions and expanded financial flexibility. For instance, the PayPal Cashback Mastercard remains a top choice for shoppers, offering competitive rewards, while the PayPal Credit Card provides flexible financing with instant credit approval.

Beyond traditional payments, PayPal has deepened its foothold in cryptocurrency, allowing users to buy, sell, and hold digital assets directly through its mobile app. The integration with Paxos Trust Company ensures regulatory compliance, giving users peace of mind. Meanwhile, Venmo, PayPal’s peer-to-peer payment arm, has evolved with enhanced social features and business tools, further solidifying its appeal among younger demographics.

For those seeking everyday financial management, PayPal’s debit card and high-yield savings options (with attractive APY rates) cater to both spenders and savers. The PayPal World program continues to reward loyal users with exclusive perks, from cash back incentives to travel benefits. With FDIC insurance on eligible accounts, PayPal balances security with innovation, ensuring users’ funds are protected while they leverage cutting-edge payment systems. Whether you’re splitting bills with friends, shopping online, or exploring crypto, PayPal’s 2025 ecosystem is designed to simplify and enhance every financial move.

Pro Tip: For frequent shoppers, linking the PayPal Debit Card to your account maximizes convenience—instant access to funds with no credit checks, plus eligibility for select cashback promotions. Small businesses, on the other hand, can leverage PayPal’s invoicing and financial services to streamline operations and reach global customers effortlessly.

Professional illustration about PayPal

How PayPal Works Today

How PayPal Works Today

In 2025, PayPal remains a powerhouse in financial technology, offering a seamless digital wallet experience that integrates payments, banking, and even cryptocurrency management. At its core, PayPal functions as a payment processing platform, allowing users to send and receive money globally with just an email or phone number. Whether you're shopping at an online checkout, splitting bills via Venmo (owned by PayPal), or using a PayPal Credit Card for purchases, the platform prioritizes speed and security.

One of PayPal's standout features is its buy now pay later (BNPL) service, which lets users split purchases into interest-free installments—a game-changer for budget-conscious shoppers. For those who prefer cash rewards, the PayPal Cashback Mastercard offers up to 3% back on eligible purchases, while the PayPal Debit Card provides instant access to funds stored in your account. Both cards are issued through partners like Synchrony Bank and The Bancorp Bank, ensuring FDIC insurance for eligible balances.

Behind the scenes, PayPal leverages partnerships with Mastercard and Paxos Trust Company to expand its services, including crypto trading and high-yield savings through PayPal World. Users can earn competitive APY rates on savings or even use cryptocurrency to pay at millions of merchants. The mobile app further enhances convenience, offering one-touch logins, real-time spending alerts, and instant credit approval for eligible financial products.

For businesses, PayPal’s payment systems simplify transactions with customizable invoicing, subscription management, and fraud protection. Sellers can accept payments in multiple currencies, while buyers enjoy perks like purchase protection and easy returns. Whether you're freelancing, running an e-commerce store, or just managing personal finances, PayPal’s ecosystem—backed by decades of trust—delivers a unified financial service experience tailored for the digital age.

Security remains a top priority, with encryption, two-factor authentication, and AI-driven fraud detection safeguarding every transaction. Plus, with FDIC-insured options for cash balances (via partner banks), users can trust PayPal as both a spending and savings tool. From peer-to-peer transfers to global commerce, PayPal’s 2025 infrastructure is designed to keep up with the evolving demands of financial technology, making it a must-have in any modern wallet.

Professional illustration about Bancorp

PayPal Fees Explained

PayPal Fees Explained

Understanding PayPal’s fee structure is crucial for both personal and business users to avoid surprises when sending money, shopping online, or using financial services like PayPal Credit Card or PayPal Debit Card. Here’s a breakdown of the most common fees you’ll encounter in 2025:

Standard Transactions: For personal payments within the U.S. using a PayPal balance or linked bank account, fees are typically free. However, sending money via credit or debit cards (including Mastercard) incurs a 2.9% fee plus a fixed $0.30 per transaction. International transfers can cost up to 5% depending on the destination, with additional currency conversion fees.

Business and Merchant Fees: If you run an online store, PayPal charges 3.49% + $0.49 per transaction for online checkout via its payment processing system. In-person QR code payments are slightly lower at 1.9% + $0.10. High-volume merchants may negotiate custom rates with PayPal.

Instant Transfers: Need cash fast? Transferring money from your digital wallet to a linked bank account instantly costs 1.75% (with a minimum fee of $0.25 and max of $25). Standard bank transfers are free but take 1-3 business days.

Cryptocurrency Transactions: PayPal’s partnership with Paxos Trust Company allows users to buy, sell, or hold crypto, but fees apply. Buying Bitcoin or Ethereum incurs a spread-based fee (typically 1.5-2%), while conversions between crypto and fiat currencies may have additional costs.

PayPal Credit and Loans: The PayPal Cashback Mastercard, issued by Synchrony Bank, offers 2-3% cash back on purchases but carries a variable APR (currently 18.99-28.99% as of 2025). Late payments trigger a $40 fee. Meanwhile, PayPal’s "Buy Now, Pay Later" service is interest-free if repaid in four installments, but missed payments incur late fees up to $10.

FDIC Insurance and Limitations: Funds in PayPal Balance or Venmo accounts are held by The Bancorp Bank or FDIC-insured partner banks, but this only covers cash balances—not investments, crypto, or credit lines.

Special Cases: Withdrawing to international banks? Fees range from $0.99 to $4.99 depending on the amount. For PayPal World users, cross-border commerce fees can add up quickly, so always check the latest rates before processing large transactions.

Pro Tip: To minimize fees, link a bank account instead of a card for free transfers, use PayPal’s mobile app for fee calculators, and review your account’s fee schedule quarterly—especially if you’re a frequent user of financial technology services. Businesses should explore PayPal’s discounted rates for nonprofits or subscription-based models.

Professional illustration about Venmo

PayPal Security Features

PayPal Security Features: Keeping Your Money and Data Safe in 2025

When it comes to digital wallets and payment processing, PayPal remains a leader in financial technology, thanks to its robust security measures. Whether you're using PayPal, Venmo, or any of its financial services, the platform prioritizes protecting your transactions and personal data. Here’s a breakdown of the key PayPal security features that make it a trusted choice for millions in 2025.

PayPal uses end-to-end encryption to safeguard every transaction, ensuring your financial details are never exposed. The platform also employs AI-driven fraud detection to monitor suspicious activity in real time. For example, if an unusual purchase is made with your PayPal Debit Card or PayPal Credit Card, the system may flag it and request verification. Additionally, PayPal’s Buy Now, Pay Later service includes extra layers of authentication to prevent unauthorized use.

Funds held in your PayPal digital wallet are eligible for FDIC insurance (up to $250,000 per account) through partnerships with The Bancorp Bank and Synchrony Bank. This means even if PayPal faced financial issues, your money would still be protected. For those using PayPal Cashback Mastercard, the card is issued by Synchrony Bank, which adds another layer of security with zero-liability fraud protection.

In 2025, PayPal has enhanced its mobile app security with biometric login options, including fingerprint and facial recognition. Enabling 2FA adds an extra step to verify your identity, reducing the risk of unauthorized access. This is especially useful for high-value transactions or when linking new payment methods like Mastercard or cryptocurrency wallets.

PayPal’s Purchase Protection program covers eligible purchases if they arrive damaged, aren’t as described, or never show up. For online checkout disputes, PayPal’s resolution center helps mediate between buyers and sellers, often issuing refunds if the claim is valid. This feature is a major advantage over traditional payment systems, giving users peace of mind when shopping online.

With Paxos Trust Company handling PayPal’s cryptocurrency services, users benefit from secure crypto transactions and storage. The platform also offers tools like credit approval checks and spending alerts to help you manage your PayPal Credit Card or PayPal World account responsibly.

While PayPal’s built-in security is strong, users should also take precautions:

- Regularly update your mobile app to ensure you have the latest security patches.

- Avoid sharing login details or clicking on suspicious links claiming to be from PayPal.

- Monitor your cash back rewards and transaction history for any irregularities.

By combining these PayPal security features with smart habits, you can confidently use PayPal for everything from everyday purchases to high-stakes financial services. Whether you're a casual shopper or a frequent user of PayPal’s payment processing, these measures ensure your money and data stay protected in 2025.

PayPal vs Competitors

Here’s a detailed, SEO-optimized paragraph on PayPal vs Competitors in conversational American English, incorporating your specified keywords naturally:

When comparing PayPal to its competitors, it’s clear that the platform stands out for its versatility—but rivals like Venmo (owned by PayPal) or Mastercard-backed services carve their own niches. PayPal’s strength lies in its financial technology ecosystem: the PayPal Cashback Mastercard offers up to 3% cash back, while the PayPal Debit Card provides FDIC-insured balances through The Bancorp Bank. Competitors, however, target specific pain points. For example, Venmo dominates peer-to-peer payments among younger users with its social feed, while Synchrony Bank-powered store cards often offer higher APYs for savings. PayPal’s buy now, pay later feature competes with Klarna and Afterpay, but its integration with cryptocurrency trading (via Paxos Trust Company) gives it an edge for crypto enthusiasts.

Where PayPal truly shines is online checkout—its one-tap payment processing is accepted at 80% of top U.S. retailers, far outpacing niche digital wallets. Yet, competitors like Apple Pay leverage hardware integration (e.g., iPhone NFC), and Mastercard’s global network offers broader ATM access. PayPal’s mobile app consolidates services like PayPal Credit Card approvals and PayPal World transfers, but lacks the physical branch support of traditional banks. For small businesses, PayPal’s payment systems are easier to set up than merchant accounts from Synchrony Bank, though transaction fees can be steeper.

The choice boils down to use cases: Need cash back and omnichannel flexibility? PayPal wins. Prioritizing high-yield savings or in-person financial services? Competitors might suit better. Even within PayPal’s own family, Venmo’s casual UX contrasts with PayPal’s business-first tools—proving that in fintech, one size doesn’t fit all.

This paragraph avoids intros/conclusions, uses markdown formatting sparingly, and balances keywords with actionable insights. Let me know if you'd like adjustments!

PayPal for Businesses

PayPal for Businesses: The Ultimate Payment Solution

For businesses looking to streamline their payment processing, PayPal offers a robust suite of tools designed to simplify transactions, enhance security, and boost customer satisfaction. Whether you're a small startup or an established enterprise, PayPal's digital wallet and payment systems integrate seamlessly with your existing operations. With features like online checkout and mobile app compatibility, customers can pay effortlessly using their preferred method—be it PayPal Credit Card, PayPal Debit Card, or even Venmo for peer-to-peer transfers.

One of the standout benefits for businesses is PayPal's buy now, pay later (BNPL) option, which can increase conversion rates by allowing customers to split purchases into manageable installments. This flexibility is backed by Synchrony Bank and The Bancorp Bank, ensuring reliable credit approval processes. Additionally, businesses can leverage the PayPal Cashback Mastercard to earn rewards on purchases, while the PayPal World program provides exclusive perks for high-volume sellers.

For those venturing into cryptocurrency, PayPal's partnership with Paxos Trust Company ensures secure crypto transactions, making it easier to tap into this growing market. The platform also supports FDIC-insured accounts, adding an extra layer of trust for both businesses and customers.

From payment processing to financial technology innovations, PayPal continues to evolve, offering competitive APY rates on business savings and advanced fraud protection. Whether you're handling international sales or local transactions, PayPal's ecosystem is designed to scale with your needs, making it a top choice for modern businesses.

PayPal Mobile App Guide

The PayPal Mobile App is your all-in-one digital wallet for seamless payments, money management, and even cryptocurrency transactions—all from your smartphone. Whether you're splitting dinner with friends via Venmo (now fully integrated into PayPal's ecosystem), earning cash back with the PayPal Cashback Mastercard, or using buy now pay later options at checkout, the app puts financial control at your fingertips. With over 430 million active accounts globally, PayPal continues to dominate payment processing, and its 2025 updates make the mobile experience faster and more intuitive than ever.

Key Features You Should Master:

- One-Tap Payments: Link your PayPal Debit Card, PayPal Credit Card, or external Mastercard for instant online checkout. The app stores your preferred payment method, so you don’t need to re-enter details.

- FDIC-Insured Balances: Funds held in your PayPal Balance account are eligible for pass-through FDIC insurance up to $250,000 through partner banks like The Bancorp Bank and Synchrony Bank.

- High-Yield Savings: Earn a competitive APY on savings through PayPal’s partnership with Paxos Trust Company, a leader in financial technology.

- PayPal World Rewards: Exclusive discounts and cashback deals for frequent users, accessible directly from the app’s dashboard.

Pro Tips for Power Users:

1. Credit Approval On-the-Go: Apply for a PayPal Credit Card directly in the app—approval decisions often take seconds. If approved, the virtual card is instantly available for use.

2. Crypto Integration: Buy, sell, or hold Bitcoin and Ethereum with real-time market tracking. PayPal’s secure vault ensures your assets are protected.

3. Split Purchases: Use the "Pay in 4" payment systems to divide larger purchases into interest-free installments, perfect for budget-conscious shoppers.

Security First:

PayPal’s app employs biometric login (Face ID or fingerprint) and 24/7 transaction monitoring to guard against fraud. For added peace of mind, enable two-factor authentication and set spending alerts—especially if you’re using the app for both personal and business financial services.

Little-Known Hack:

Did you know you can use the app to pay at physical stores? Just generate a one-time barcode at participating retailers—no card needed. This works even if your PayPal Debit Card isn’t physically with you.

Whether you’re a casual user or a financial technology enthusiast, the PayPal Mobile App adapts to your needs. From instant peer-to-peer transfers to managing your entire digital wallet, it’s designed to simplify how you handle money in 2025.

PayPal International Transfers

PayPal International Transfers: A Seamless Global Payment Solution

When it comes to sending money across borders, PayPal stands out as a trusted and efficient platform. Whether you're paying freelancers, supporting family abroad, or handling business transactions, PayPal's international transfer service simplifies the process. With support for over 200 countries and 25 currencies, it’s a go-to for users who need fast, secure, and low-fee transfers. Unlike traditional banks, which often charge hefty fees and take days to process, PayPal leverages its financial technology to offer competitive exchange rates and quicker delivery times—usually within minutes if both parties have PayPal accounts.

One of the key advantages is PayPal’s integration with Venmo (for U.S. users), allowing seamless transfers between the two platforms. However, international transfers via Venmo aren’t supported, so PayPal remains the primary tool for cross-border payments. For frequent senders, the PayPal Debit Card or PayPal Cashback Mastercard can be useful, offering rewards like cash back on eligible purchases, which can offset transfer fees. Additionally, PayPal Credit Card users may enjoy flexible financing options, though credit approval is required.

For businesses, PayPal’s payment processing system supports multi-currency accounts, making it easier to invoice clients worldwide without worrying about currency conversion hassles. The mobile app further enhances convenience, letting users track transfers in real-time and manage their digital wallet on the go. While PayPal isn’t a bank, funds held in PayPal balances are eligible for FDIC insurance through partner institutions like The Bancorp Bank or Synchrony Bank, adding a layer of security.

For those exploring cryptocurrency, PayPal also allows buying, selling, and transferring select crypto assets internationally, though fees and availability vary by region. Another perk is PayPal World, which offers exclusive benefits for high-volume users, including discounted fees and priority customer support.

However, it’s worth noting that PayPal’s fees for international transfers can add up, especially for smaller amounts. Alternatives like buy now, pay later services or direct bank transfers might be more cost-effective depending on the scenario. Always compare exchange rates and fees before initiating a transfer. Overall, PayPal’s blend of speed, security, and global reach makes it a top choice for payment systems in 2025.

PayPal Buyer Protection

PayPal Buyer Protection is one of the standout features that make PayPal a trusted financial service for online shoppers in 2025. Whether you're using the PayPal Credit Card, PayPal Debit Card, or even the PayPal Cashback Mastercard, this program ensures you're covered if something goes wrong with your purchase. Here’s how it works: if an item doesn’t arrive, is significantly different from the seller’s description, or is damaged, PayPal may reimburse you for the full purchase price plus shipping costs—up to $20,000 per claim. This applies to eligible purchases made through PayPal’s payment processing system, including transactions completed via Venmo when the "Goods and Services" option is selected.

To qualify for PayPal Buyer Protection, you’ll need to meet a few requirements. First, the transaction must be marked as "Eligible" or "Partially Eligible" on PayPal’s platform. Second, you must file a dispute within 180 days of the purchase date. PayPal’s mobile app and website make it easy to initiate a claim, and their resolution process typically involves submitting evidence like photos, tracking information, or correspondence with the seller. For example, if you bought a limited-edition sneaker through an online marketplace but received a counterfeit pair, PayPal’s team would review your case and likely issue a refund if the seller can’t resolve the issue.

One of the key advantages of this program is its integration with major payment systems like Mastercard, which adds an extra layer of security. If PayPal’s resolution doesn’t work in your favor, you might still be able to escalate the claim through your card issuer, such as Synchrony Bank (which backs the PayPal Credit Card) or The Bancorp Bank (associated with the PayPal Debit Card). Additionally, PayPal’s partnership with Paxos Trust Company for cryptocurrency transactions means that even certain crypto purchases may be covered under modified terms.

For frequent online shoppers, combining PayPal Buyer Protection with other features like buy now pay later or cash back rewards can maximize both security and value. For instance, using the PayPal Cashback Mastercard for a big-ticket purchase not only earns you 2% cash back but also ensures you’re protected if the merchant fails to deliver. It’s worth noting that while PayPal isn’t FDIC-insured like a traditional bank, its buyer protection policies fill a critical gap for financial technology users who prioritize safe online transactions.

A few pro tips to get the most out of this program:

- Always check that the seller’s PayPal account is in good standing before completing a transaction.

- Use PayPal’s online checkout instead of direct bank transfers or peer-to-peer payments (like Venmo’s "Friends and Family" option) to ensure eligibility.

- Keep detailed records of your purchases, including screenshots of product listings and saved email receipts.

In 2025, scams and misrepresented goods are still a reality, but PayPal Buyer Protection remains a robust shield for consumers. Whether you’re shopping on a global marketplace like PayPal World or a small business’s website, this feature adds peace of mind to every transaction. Just remember—while PayPal’s policies are comprehensive, they’re not a substitute for common sense. Always research sellers, read reviews, and be cautious with deals that seem too good to be true.

PayPal Seller Fees

Understanding PayPal Seller Fees in 2025: A Breakdown for Small Businesses and Entrepreneurs

If you're selling online in 2025, PayPal remains one of the most popular payment processing systems, but its fee structure can be tricky to navigate. Whether you're using PayPal for online checkout, invoicing, or even cryptocurrency transactions, knowing the latest seller fees is critical to maximizing profits. Here’s what you need to know about PayPal seller fees this year.

Standard Transaction Fees

For most U.S. sellers, PayPal charges 2.99% + $0.49 per transaction when customers pay with a PayPal account, Venmo, or PayPal Credit Card. If the buyer uses a debit or credit card (like Mastercard) directly without a PayPal account, the fee jumps to 3.49% + $0.49. These rates are competitive with other financial technology platforms but can add up quickly for high-volume sellers.

Micropayments for Small Transactions

If you sell low-cost items (under $10), PayPal’s Micropayments pricing might save you money. Instead of the standard rate, you’ll pay 5% + $0.05 per transaction. This is ideal for digital products, eBooks, or subscription services where small fees eat into margins.

International and Currency Conversion Fees

Selling globally? PayPal World adds a 1.5% fee for cross-border transactions on top of the standard rate. If the payment is in a foreign currency, expect another 3-4% conversion fee. For example, if a customer in Germany pays €50, you’ll lose roughly €2.25 just in currency conversion.

PayPal’s Buy Now, Pay Later (BNPL) Impact

With PayPal’s BNPL service growing in popularity, sellers should note that fees for these transactions match standard rates (2.99% + $0.49). However, PayPal absorbs the risk of missed payments, making it a safer option than some competitors.

Special Cases: Nonprofits, Marketplaces, and High-Risk Businesses

- Nonprofits qualify for discounted rates (2.89% + $0.49) but must submit documentation.

- High-risk businesses (e.g., CBD, gaming) face higher fees or outright bans due to PayPal’s strict policies.

Avoiding Hidden Costs

- Chargebacks cost $20 per dispute, so clear return policies are a must.

- Instant Transfer Fees: Moving money to your debit card or bank instantly costs 1.5% (capped at $15). Standard transfers (1-3 days) are free.

- Inactivity Fees: If your PayPal balance sits unused for 12+ months, you’ll be charged $20 annually—a sneaky fee many miss.

Pro Tips to Reduce Fees

1. Bundle small transactions to qualify for Micropayments pricing.

2. Encourage customers to pay with PayPal balances or Venmo to avoid higher card-processing fees.

3. Use PayPal’s mass payout tool for bulk payments (flat $2 fee per transfer).

4. Negotiate rates if you process over $3,000 monthly—PayPal sometimes offers custom pricing.

The FDIC Factor and PayPal’s Banking Partners

While PayPal isn’t a bank, funds held in PayPal Cashback Mastercard or PayPal Debit Card accounts are FDIC-insured through partners like The Bancorp Bank and Synchrony Bank. However, seller fees are unrelated to FDIC coverage—this only protects your balance if PayPal goes under.

Final Note: Crypto and PayPal’s Evolving Ecosystem

If you accept cryptocurrency via Paxos Trust Company, PayPal converts crypto to USD instantly, charging the standard 2.99% + $0.49 fee. Keep an eye on updates—PayPal has hinted at dynamic pricing for crypto transactions later in 2025.

By understanding these fees and strategies, sellers can make smarter decisions about integrating PayPal into their payment systems. Always check PayPal’s official site for the latest updates, as rates and policies shift frequently in the financial services space.

PayPal Credit Options

PayPal Credit Options: Flexible Financing for Every Need

When it comes to managing finances online, PayPal offers a suite of credit options designed to fit different spending habits and financial goals. Whether you're looking for a PayPal Credit Card with cash back rewards, a PayPal Debit Card linked to your digital wallet, or the PayPal Cashback Mastercard for everyday purchases, there's a solution tailored to your needs. For bigger purchases, PayPal Credit (issued by Synchrony Bank) provides a revolving line of credit with promotional financing, often featuring "buy now, pay later" offers like 6- or 12-month interest-free periods. This makes it ideal for splurging on tech gadgets or home upgrades without immediate financial strain.

For users who prefer debit over credit, the PayPal Debit Card taps directly into your balance, offering FDIC-insured security through The Bancorp Bank. Meanwhile, the PayPal Cashback Mastercard (backed by Synchrony Bank) rewards users with 2-3% cash back on purchases, making it a strong contender among financial technology tools. Small business owners can leverage PayPal Working Capital for quick loans, while crypto enthusiasts appreciate PayPal's integration with Paxos Trust Company for cryptocurrency transactions.

What sets PayPal apart is its seamless integration across platforms—whether you're using the mobile app for payment processing or checking out online with Venmo (owned by PayPal). The PayPal World ecosystem ensures compatibility with Mastercard networks, and features like credit approval in minutes add convenience. Pro tip: If you're torn between options, compare APY rates (for savings-linked products) and fees—some cards waive annual fees but may charge higher interest for carried balances. Always review terms to align with your financial service needs.

For budget-conscious shoppers, PayPal's "Pay in 4" splits payments into four interest-free installments, a smarter alternative to traditional credit. And if you're stacking rewards, pair the PayPal Cashback Mastercard with the main app to maximize points on online checkout purchases. Whether you're building credit, earning rewards, or accessing flexible financing, PayPal's credit solutions adapt to modern payment systems—no outdated hurdles, just streamlined financial control.

PayPal Cryptocurrency Support

PayPal Cryptocurrency Support in 2025: What You Need to Know

PayPal has solidified its position as a leader in financial technology by expanding its cryptocurrency services, making it easier than ever for users to buy, sell, and hold digital assets directly through its digital wallet. As of 2025, PayPal supports Bitcoin, Ethereum, Litecoin, and Bitcoin Cash, offering a seamless integration with its payment processing ecosystem. Whether you're using the PayPal mobile app or accessing your account via desktop, the platform provides real-time price tracking and secure transactions backed by Paxos Trust Company, a regulated entity ensuring compliance and safety.

One standout feature is the ability to use cryptocurrency for online checkout at millions of merchants that accept PayPal. When you pay with crypto, the amount is automatically converted to fiat currency, eliminating volatility concerns for sellers. This functionality bridges the gap between traditional payment systems and decentralized finance, appealing to both crypto enthusiasts and everyday shoppers. Additionally, PayPal’s partnership with Mastercard enables users to spend their crypto holdings via the PayPal Debit Card, which converts digital assets to USD at the point of sale—a game-changer for mainstream adoption.

For those looking to earn rewards, the PayPal Cashback Mastercard now offers limited-time promotions for crypto purchases, combining the benefits of cash back with digital asset investments. Meanwhile, PayPal Credit Card users can leverage buy now pay later options for crypto transactions, though credit approval is subject to terms set by Synchrony Bank or The Bancorp Bank, depending on the cardholder’s agreement.

Security remains a top priority. While PayPal’s crypto services are not FDIC-insured like traditional deposits, the platform employs robust encryption and fraud detection tools to safeguard user funds. Notably, Venmo, PayPal’s peer-to-peer payment subsidiary, also supports cryptocurrency transactions, further expanding accessibility for younger demographics.

Looking ahead, PayPal continues to innovate within PayPal World, its global initiative to integrate crypto into everyday finance. With features like staking (earning APY on held assets) rumored to launch soon, the platform is poised to redefine how consumers interact with financial services. Whether you're a casual investor or a seasoned trader, PayPal’s crypto tools offer a user-friendly gateway into the digital economy—without the complexity of third-party exchanges.

Pro Tip: If you're new to crypto, start small. Use PayPal’s educational resources to understand market trends before making larger investments. And always monitor your mobile app notifications for real-time updates on crypto price movements or promotional offers.

PayPal Customer Support

PayPal Customer Support: How to Get Help Quickly in 2025

Navigating PayPal’s customer support can be straightforward if you know where to look. Whether you’re using PayPal’s digital wallet, managing a PayPal Credit Card, or troubleshooting payment processing issues, the platform offers multiple ways to resolve problems. Here’s a breakdown of your options:

1. Self-Service Support

PayPal’s mobile app and website include a robust Help Center with step-by-step guides for common issues like disputes, online checkout errors, or cryptocurrency transactions. For example, if your PayPal Debit Card is declined, the Help Center walks you through checking your balance or updating card details. You can also access FAQs for Synchrony Bank-backed services like the PayPal Cashback Mastercard or The Bancorp Bank-managed PayPal World accounts.

2. Live Chat and Phone Support

For urgent matters—such as unauthorized transactions or FDIC-insured account concerns—PayPal’s live chat (available 24/7) connects you to agents in under 5 minutes. Pro tip: Use the chat for buy now pay later (BNPL) questions, as reps can clarify eligibility based on your credit approval history. Phone support is another option, though wait times vary. If you’re a PayPal Credit Card holder, dialing the number on the back of your card (issued by Synchrony Bank) often gets faster service.

3. Social Media and Community Forums

PayPal’s X (formerly Twitter) and Facebook teams respond within hours, making this ideal for public-facing issues (e.g., delayed Venmo transfers). The PayPal Community forum is another gem, where users share fixes for niche problems like APY discrepancies on savings products or Mastercard chargeback rules.

4. Escalating Complex Issues

If standard channels don’t resolve your problem—say, a dispute with Paxos Trust Company over crypto holdings—request escalation via PayPal’s Resolution Center. Document everything: Screenshots of error messages, timestamps, and reference numbers strengthen your case. For financial service-related complaints (e.g., Synchrony Bank fees), you can file a formal grievance with the Consumer Financial Protection Bureau (CFPB).

5. Specialized Support for Businesses

Merchants using PayPal’s payment systems can access priority support. The PayPal Business app includes a dedicated helpline for troubleshooting financial technology integrations, chargebacks, or bulk payout delays. High-volume sellers even get assigned account managers.

Pro Tips for Faster Resolutions

- Always note your case ID when contacting support.

- For PayPal Debit Card issues, confirm your card is activated and linked to a primary balance (not just Venmo funds).

- Check if your concern falls under FDIC insurance (e.g., PayPal Savings balances) before escalating.

- Use the app’s “Call Me” feature to avoid hold music—it’s faster than dialing manually.

PayPal’s support ecosystem is evolving, with 2025 updates like AI-powered chat for cash back inquiries and expanded cryptocurrency dispute tools. Whether you’re a casual user or a business leveraging payment processing, knowing these channels saves time and stress.

PayPal Account Setup

Setting up a PayPal account in 2025 is a seamless process that unlocks access to one of the world’s most versatile digital wallets. Whether you’re looking to shop online, send money to friends, or even dabble in cryptocurrency, PayPal’s platform integrates these financial services into a single, user-friendly mobile app. Here’s a step-by-step breakdown to get you started:

First, download the PayPal app from the App Store or Google Play, or visit the official website. Click Sign Up and choose between a Personal or Business* account—the latter is ideal for freelancers or small businesses leveraging payment processing. You’ll need to provide basic details like your name, email, and a secure password. PayPal’s financial technology ensures your data is encrypted, so security isn’t a concern.

Next, link a funding source. You can connect a bank account, Mastercard, or other major credit/debit cards. For added flexibility, consider applying for a PayPal Credit Card or PayPal Debit Card, which offer perks like cash back or buy now pay later options. If you’re into crypto, PayPal’s partnership with Paxos Trust Company lets you buy, sell, and hold cryptocurrencies directly in your account.

Verify your identity by confirming your email and phone number. For full functionality—like higher transaction limits—you may need to provide additional documentation, such as a government-issued ID. Once verified, explore features like PayPal Cashback Mastercard (issued by Synchrony Bank) or the PayPal World program for exclusive merchant discounts.

Pro tip: Enable two-factor authentication (2FA) for extra security. PayPal also supports FDIC-insured balances through partnerships with The Bancorp Bank, so funds in your digital wallet are protected up to $250,000. For frequent shoppers, link Venmo (owned by PayPal) for peer-to-peer payments or use online checkout buttons for instant purchases.

Finally, customize your account settings. Set up payment systems like auto-reload for your PayPal balance or enable APY-earning savings options if available. Whether you’re paying bills, shopping, or sending money internationally, PayPal’s financial service ecosystem adapts to your needs. Just remember: Always keep your app updated to access the latest features, like credit approval pre-checks or real-time spending analytics.

PayPal Future Trends

As we move further into 2025, PayPal continues to redefine the future of financial technology, with innovations that blend convenience, security, and flexibility. One of the most notable trends is the expansion of cryptocurrency integration within the PayPal ecosystem. Users can now buy, sell, and hold cryptocurrencies directly through the mobile app, and rumors suggest that PayPal may soon partner with Paxos Trust Company to offer even more seamless crypto-to-fiat conversions. This positions PayPal as a bridge between traditional payment systems and the emerging digital asset economy.

Another key development is the growing popularity of buy now pay later (BNPL) services. PayPal Credit Card and PayPal Debit Card users can now split purchases into interest-free installments, a feature that’s particularly appealing to younger consumers. Competitors like Venmo (owned by PayPal) are also rolling out similar BNPL options, making PayPal World a dominant player in this space. For those who prefer rewards, the PayPal Cashback Mastercard remains a top choice, offering up to 3% cash back on purchases—a perk that’s hard to beat in today’s competitive financial service landscape.

Security and trust are also at the forefront of PayPal’s future roadmap. The company has been working closely with FDIC-insured banks like Synchrony Bank and The Bancorp Bank to ensure user funds are protected. Additionally, PayPal is leveraging Mastercard’s advanced fraud detection systems to enhance safety during online checkout. These partnerships not only bolster consumer confidence but also streamline payment processing for merchants.

Looking ahead, PayPal is expected to introduce higher-yield savings options, potentially offering competitive APY rates through its digital wallet. This would align with the broader trend of fintech companies blurring the lines between banking and payment systems. Whether you’re a frequent online shopper, a crypto enthusiast, or someone who values flexible payment solutions, PayPal’s evolving features are designed to cater to your needs—making it a one-stop shop for modern financial technology.